Kyber Ventures Monthly Update - May

Most of us are already familiar with Kyber Network, one of the OG and best DEX’s deployed on 11 chains. As the name suggests, Kyber Ventures is an investment arm of Kyber Network with the goal of supporting entrepreneurs building the next giants of the decentralized world.

Founded in Jan 2022, Kyber Ventures may be young but our team members have many years of experience in the crypto space and share expertise through the rise and fall of crypto. We, Kyber Ventures, are privileged to share our insights, experience, and connections to guide early-stage web3 projects and founders.

From this month onwards, we will release a monthly report providing high level market overviews across the various categories, updates on Kyber Ventures' investments, as well as lessons and insights we learn along the way. It will be a short but enriching report so we hope you will subscribe to our newsletter and join us in our journey.

Sell in May and come on back in September

May 2022 was undoubtedly one of the worst months for crypto holders in the last five years. Bitcoin had its longest losing streak to date, closing in the red for nine weeks, the $40B Luna's Unstablecoin Crash, the 40-year high inflation rate, the worst bonds bear market since 1949, and the list goes on. Let's dive in one by one.

Bitcoin

BTC fell below $30,000 with 9 weeks in red, the lowest price being over 55% down from the ATH and back to last year's May price. The downward price can be evaluated as a result of several factors; bad economic conditions, the US Federal Reserve's attempt to tighten liquidity, and the Terra chaos. FED had already raised its basic interest rate twice this year, market estimate they will in 5 times more in 2022 and the interest rate could reach around 3% by end of this year. Crypto price is sensitive to the availability of capital and broader economic conditions; therefore we expect the market to accommodate these factors in Q2 and Q3 2022.

DEFI

Total TVL in DeFi is down nearly 50%, while BTC is down ~30% compared to two months ago on April 1st. Amongst DeFi Projects, Anchor experienced the biggest drop in TVL from $16.6 billion at the end of April to $0 now. Other major drops include Curve, Lido, and Convex Finance, all down ~50% in a month. ETH and altcoins tend to underperform BTC in a bear market, but the recent news about delaying the Ethereum merge to Q3 by Vitalik Buterin rubs off on the ETH price badly. We may not see DeFi 3.0 or DeFi bull run any time soon but the DeFi space is still where the most liquidity, volume, and steady user engagements happen. The recent launch of Coinbase's new dapp wallet and browser will also go a long way in helping mainstream adoption into the DeFi space as well. We can expect to see more complicated and innovative decentralized finance instruments that will lead to the next DeFi bull run during this bear market.

StableCoins

(Coingecko, June 1st)

The competition between stablecoins is getting fiercer day by day, with 84 stablecoins currently registered on CoinGeko and 10 individual stablecoins holding a market capitalization of more than $500M each. Most new stablecoin projects do not settle successfully and as a result, disappear in a short time. In particular, the algorithm stablecoin where Luna's unstable coin situation is representative caused a lot of controversies, including the damage of user's assets due to price depeg, in addition to bringing distrust to the government and users in the cryptocurrency market as a whole. Luna Foundation Labs abandoned the original chain with UST and launched a new chain Mainnet last week, hinting that the new chain will issue another stable coin backed by hard money.

After Terra's algorithm Stablecoin UST collapsed, concerns about another stablecoin, USDT, were raised due to a lack of transparency on their reserve. USDT has not recovered a $1 pegging, and to date, about $10B sells have occurred. Stablecoin is one of the key elements for the mass adoption of cryptocurrency, both developers and users should be relatively conservative in developing coin structures and adoptions to prevent another Luna crisis. But crypto communities and projects always come up with new solutions. We are confident that a new stablecoin will be developed in the near future that will remain stable as a rock without requiring continuous demand or arbitrage activities, but with high capital efficiency and decentralization.

Kyber Ventures Investments

Over the past five months, the Kyber Ventures team has been lucky to talk with more than 100 startup founders. Time flew by with the process of sharing ideas and feedback with smart, like-minded and passionate people and preparing project launches. Rather than going through every single project we invested in, we will share two or three of our most recent investments and our reasons for why we invested in these projects. By the way, Twitter is always the best place to get updates first, so don't forget to follow us on Twitter! The projects Kyber Ventures is proud to introduce this month are Finblox, Algoblocks and Cyberium.

Finblox

Finblox is a centralized interest-earning platform focusing on the Asian market. The platform launched in January 2022 and supports multiple L1 tokens and stable coins. Their AUM and number of users are growing steadily in Vietnam, Indonesia, India, and the Philippines, thanks to their localized customer service and easy UI/UX designs.

Centralized lending platforms' profits have been increasing for the last three years and we expect this category to continue to grow given that more retail holders, institutions, and trading firms are getting into crypto. Most crypto newbies who are not familiar with using non-custodial wallets and Dapps will stay on centralized platforms, paired with the insane rate of crypto adoption in emerging countries, it could be a match made in heaven.

BlockFi generated nearly $100 million worth of revenue in 2020 (+22x FY'19 revenue) at nearly ~30% gross profit margins. The company is profitable entering 2021." (source) BlockFi’s platform currently manages more than $15 billion in assets. From a revenue just short of $100 million in 2020, the startup is on a run toward generating $500 million in revenues in 2021. (source)

Nexo has set a payment of $6,127,981.39 to NEXO token holders for August 15th, 2020, representing 30% of its net profit for the period between June 30th, 2019, and June 30th, 2020, despite the current instability in the financial markets. The dividend was 154.32% higher than the previous dividend. (source)

Lending platforms, in general, are well-positioned to target both active and passive crypto investors and their business works in both bear & bull markets. Passive investors are willing to earn interest with stable coins and active investors might hold BTC and ETH to have upside market exposure while making small interest on lending platforms like Finblox.

Kyber Ventures decided to invest in Finblox's equity round as we believe Finblox's resources, network, and insight into emerging markets would give them an advantage over competitors.

Algoblocks

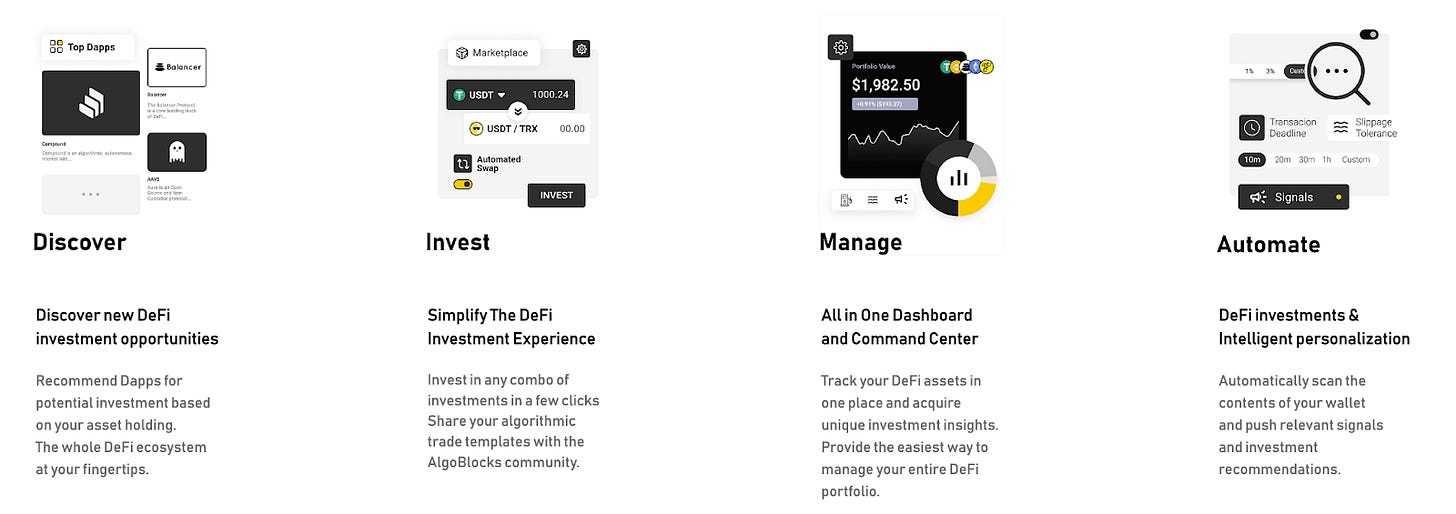

Algoblocks is a multi-chain DeFi dashboard that supports lending, dex trading, derivatives, and preset strategies. 70+ DeFi protocol integrations are planned and the beta product will go live in June. Algo’s backend tech combines on-chain data to analyze and provide signals that might help users to maximize their profit through token swaps, LM, or becoming liquidity providers. For token utility, they intend to charge a small fee on top of the token swap feature in their native token $ALGOBLK.

More and more retail users have been trading/testing crypto, but entry barriers for trying out DeFi are still high. The market needs superior, high-quality tools that really enable crypto users to use the DeFi products without being bogged down by the technicalities or complexities of blockchain. In the next DeFi bull run, we believe those secure and well-developed DeFi tools that simplify the user's journey will get the spotlight, like Algoblocks.

Despite the downturn, adoption continued as the number of DeFi wallets grew to 4.3 million unique addresses this month. Although users may have multiple wallets/addresses this data point serves as a worthy pulse on the overall health of the DeFi ecosystem. - Consensys

Curated feed based on users' on-chain data is Algoblocks' UPS. There are many amazing existing DeFi dashboards but we see the potential for Algoblocks to be a go-to platform for new, and expert DeFi users. We believe the team can successfully deliver these customized feeds and alert service features to the masses. The app will act as a personal fund manager, suggest the best offers for your crypto holdings, such as the best yield and security level, and suggest token swaps based on unusual movements in the specific crypto tokens you hold. These suggestions are made through their internally built, on-chain algorithm technology. Kyber Ventures invested in their token fundraising round.

Cyberium

Cyberium is the first-ever comprehensive sport metaverse, a centralized hub offering a revolutionary experience for e-sport lovers to play, engage, win and earn. Cyberium aims to build an e-sport metaverse world where sports fans engage in various social activities and build new types of gamers' interactions beyond playing single games.

When the Cyberium team showcased their game demos with fantastic artworks, we could see their passion and capability to build E-sport game-focused metaverse. We'd like to share why we decided to invest in this Vietnamese project below.

1. Achieved essential ingredients of a Metaverse

Decentralization and openness: All game activities and governance decisions are transparently recorded on the Binance chain. Token holders can actively participate in the project decision-making processes.

Property rights: Game players can buy and sell their in-game characters and sports items in NFT format and fully own avatars and in-game items in and outside of the Cyberium app.

Community ownership: There are many ways to generate revenue inside the Cyberium world, such as participating in the games, hosting tournaments, and creating game-related content. Cyberium economics is founded on reasonable distribution and monetization mechanisms, providing users an opportunity to earn stable profits instead of short-term earning periods.

2. The Cyberium game's quality can compete with existing e-sport mobile games. The number of traditional e-sports gamers and publishers' revenue is increasing yearly, with steady demand in the market for e-sport games. We believe this demand would shift to Cyberium type of game platforms where players can generate profits, achieve the full ownership of game items and engage with other players through various social activities beyond playing games and chattings. But everyone knows this premise works only when the game is better than the current versions. We think Cyberium's work can meet players' expectations and become one of the projects leading major adoptions to metaverse games.

One of mobile gaming's most consistently earning casual titles, Miniclip's 8 Ball Pool, has pocketed an estimated $400 million in worldwide player spending since launching in 2013, Sensor Tower Store Intelligence data shows. More than $20 million of this was grossed last quarter alone.(source)

The first E-sport game in Cyberium is the pool game that has a worldwide user base. The beta version has recently launched, go check out Cyberium's unique artworks and advanced game features!

Did you find this article interesting? Then make sure to subscribe and follow us on Twitter for more upcoming articles and reports!